Bitcoin, the pioneer of cryptocurrency, has revolutionized the global financial landscape. With its decentralized structure and ability to operate without intermediaries, Bitcoin has become a cornerstone of digital finance. CoinMarketCap, on the other hand, is one of the most authoritative platforms for cryptocurrency tracking and analytics. Together, "bitcoin coinmarketcap" forms an essential combination for those navigating the crypto world—offering transparency, insights, and tools to make informed investment decisions.

The crypto world can often feel like a maze, with thousands of coins and tokens vying for attention. Bitcoin, being the first cryptocurrency, holds a unique place in this ecosystem, often serving as a benchmark for the performance of other digital assets. CoinMarketCap complements this by providing real-time data, historical trends, and rankings, making it an indispensable resource for traders, investors, and enthusiasts. Whether you're a seasoned crypto investor or a newcomer, understanding the interplay between Bitcoin and CoinMarketCap can significantly enhance your investment strategies.

In this article, we'll delve deep into the relationship between Bitcoin and CoinMarketCap, exploring how this platform provides critical data about Bitcoin's market performance. From historical price trends and market capitalization to trading volumes and liquidity, we'll examine how CoinMarketCap empowers users to make data-driven decisions. Additionally, we'll address the importance of Bitcoin's dominance in the market and its influence on the broader cryptocurrency ecosystem.

Table of Contents

- Bitcoin: An Overview

- The History and Evolution of Bitcoin

- How Bitcoin Works: The Technology Behind It

- What is CoinMarketCap? An Introduction

- How Bitcoin is Represented on CoinMarketCap

- Understanding Bitcoin's Market Capitalization

- Bitcoin Price Trends and Historical Data

- The Role of Trading Volume in Bitcoin Analysis

- Liquidity and Volatility: Key Metrics for Bitcoin

- Bitcoin Dominance: Why It Matters

- Essential Tools on CoinMarketCap for Bitcoin Analysis

- Strategies for Investors Using Bitcoin CoinMarketCap

- Future Trends: Where Bitcoin and CoinMarketCap Are Heading

- Risks and Challenges in Bitcoin Investments

- FAQs About Bitcoin CoinMarketCap

Bitcoin: An Overview

Bitcoin, often referred to as digital gold, is the world's first decentralized cryptocurrency. Launched in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin introduced the concept of blockchain—a distributed ledger technology that ensures transparency and security. Unlike traditional currencies, Bitcoin operates without a central authority, making it resistant to censorship and inflation.

As of today, Bitcoin is not just a currency but a store of value and an investment vehicle. Its finite supply of 21 million coins has made it a hedge against inflation, comparable to precious metals like gold. With its growing adoption by individuals, businesses, and even governments, Bitcoin has firmly established itself as a mainstream financial asset.

Below is a summary of Bitcoin's key characteristics:

| Attribute | Details |

|---|---|

| Launch Year | 2009 |

| Founder | Satoshi Nakamoto |

| Maximum Supply | 21 Million BTC |

| Blockchain | Bitcoin Blockchain |

| Consensus Mechanism | Proof of Work (PoW) |

| Primary Use Cases | Currency, Store of Value, Investment |

The History and Evolution of Bitcoin

Bitcoin's journey began with the publication of the Bitcoin whitepaper in 2008, titled "Bitcoin: A Peer-to-Peer Electronic Cash System." This revolutionary document outlined the principles of a decentralized network that could facilitate trustless transactions. In January 2009, the first Bitcoin block, known as the Genesis Block, was mined by Satoshi Nakamoto, marking the beginning of the Bitcoin blockchain.

Over the years, Bitcoin has gone through numerous milestones. From being worth a fraction of a cent to reaching an all-time high of over $68,000 in 2021, its rise has been nothing short of meteoric. Along the way, Bitcoin has faced challenges, including regulatory scrutiny, market volatility, and competition from other cryptocurrencies. Despite these hurdles, Bitcoin has maintained its status as the most valuable and widely recognized cryptocurrency.

Bitcoin's history is punctuated by key events such as the launch of Bitcoin exchanges, the adoption of Bitcoin by institutional investors, and the development of layer-2 solutions like the Lightning Network. Each of these milestones has contributed to Bitcoin's resilience and growth, solidifying its position as the king of cryptocurrencies.

How Bitcoin Works: The Technology Behind It

At its core, Bitcoin operates on blockchain technology—a decentralized and immutable ledger that records all transactions. This ledger is maintained by a network of nodes, which are computers running the Bitcoin software. Transactions are validated through a process called mining, where miners solve complex mathematical problems to add new blocks to the blockchain.

Bitcoin's security is ensured by its Proof of Work (PoW) consensus mechanism, which makes it computationally expensive to alter past transactions. Additionally, Bitcoin's pseudonymous nature allows users to transact without revealing their identities, providing a level of privacy unmatched by traditional financial systems.

The technology behind Bitcoin extends beyond the blockchain. Innovations like Segregated Witness (SegWit) and the Lightning Network have improved Bitcoin's scalability and transaction speed, making it more efficient and user-friendly. These advancements demonstrate how Bitcoin continues to evolve, adapting to the needs of its growing user base.

What is CoinMarketCap? An Introduction

CoinMarketCap is a leading cryptocurrency tracking platform that provides real-time data on prices, market capitalization, trading volume, and more. Founded in 2013 by Brandon Chez, CoinMarketCap has become the go-to resource for anyone looking to analyze the cryptocurrency market. The platform offers a comprehensive overview of thousands of cryptocurrencies, including Bitcoin, making it an indispensable tool for investors and traders.

CoinMarketCap's user-friendly interface and extensive data sets make it easy to navigate the complex world of cryptocurrencies. The platform aggregates data from various exchanges, ensuring accuracy and reliability. Whether you're looking for historical price charts, market trends, or detailed project information, CoinMarketCap has you covered.

Over the years, CoinMarketCap has expanded its offerings, introducing features like educational resources, portfolio trackers, and API services. Its acquisition by Binance in 2020 further enhanced its capabilities, cementing its position as a leader in cryptocurrency analytics.

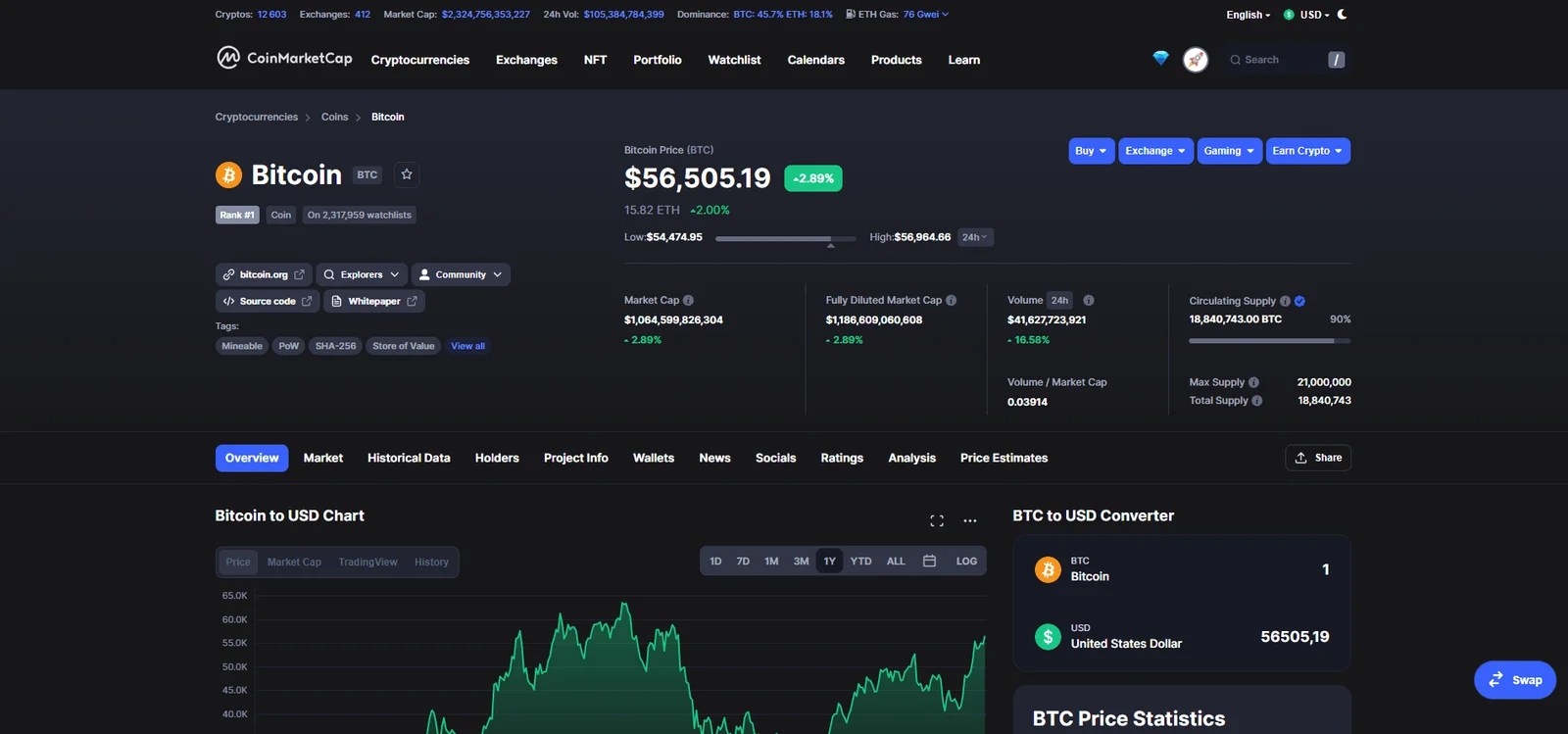

How Bitcoin is Represented on CoinMarketCap

On CoinMarketCap, Bitcoin occupies a prominent position, often topping the charts due to its market dominance. The platform provides a wealth of information about Bitcoin, including its current price, market capitalization, trading volume, and historical data. Users can also access advanced metrics like Bitcoin's dominance percentage, which indicates its share of the total cryptocurrency market.

CoinMarketCap allows users to view Bitcoin's performance across different time frames, from hourly updates to historical trends spanning years. This data is invaluable for investors looking to identify patterns and make informed decisions. Additionally, the platform provides links to Bitcoin's official website, whitepaper, and social media channels, offering a one-stop shop for all things Bitcoin.

By aggregating data from multiple exchanges, CoinMarketCap ensures that its Bitcoin statistics are accurate and up-to-date. This transparency is crucial for maintaining trust and reliability in the volatile world of cryptocurrencies.

Understanding Bitcoin's Market Capitalization

Market capitalization is a key metric used to measure the total value of a cryptocurrency. For Bitcoin, market capitalization is calculated by multiplying its current price by the total circulating supply. This metric provides a snapshot of Bitcoin's overall market value, making it a crucial indicator for investors and analysts.

On CoinMarketCap, Bitcoin's market capitalization is prominently displayed, allowing users to compare it with other cryptocurrencies. As the first and most valuable cryptocurrency, Bitcoin often commands a significant share of the total market capitalization, underscoring its dominance in the crypto space.

Market capitalization is not just a measure of value but also a reflection of investor confidence and adoption. A higher market cap indicates a more established and widely accepted cryptocurrency, making Bitcoin a safer investment compared to newer, less proven assets.

Bitcoin Price Trends and Historical Data

One of the most valuable features of CoinMarketCap is its extensive archive of Bitcoin price data. Users can view historical price charts, track Bitcoin's performance over time, and identify trends that may inform future investment decisions. From its early days of trading at a few cents to its meteoric rise to tens of thousands of dollars, Bitcoin's price history is a testament to its resilience and growth.

CoinMarketCap also provides tools for analyzing price trends, such as moving averages and other technical indicators. These tools are essential for traders looking to identify entry and exit points in the market. By combining historical data with real-time analytics, CoinMarketCap empowers users to make data-driven decisions, reducing the risks associated with cryptocurrency investments.

The Role of Trading Volume in Bitcoin Analysis

Trading volume is another critical metric available on CoinMarketCap, indicating the total amount of Bitcoin traded within a specific time frame. High trading volumes often correlate with increased market activity, providing insights into investor sentiment and market trends.

On CoinMarketCap, users can view Bitcoin's trading volume across different exchanges and time frames. This information is invaluable for identifying liquidity in the market, which is crucial for executing large trades without significantly impacting the price. Additionally, trading volume can serve as a confirmation of price trends, helping traders validate their strategies.

Liquidity and Volatility: Key Metrics for Bitcoin

Liquidity and volatility are two sides of the same coin when it comes to Bitcoin analysis. Liquidity refers to the ease with which Bitcoin can be bought or sold without affecting its price, while volatility measures the degree of price fluctuations over time. Both metrics are prominently featured on CoinMarketCap, providing a comprehensive view of Bitcoin's market dynamics.

High liquidity is often a sign of a healthy market, as it indicates a steady flow of buyers and sellers. Conversely, high volatility can either present opportunities for traders or pose risks for long-term investors. By monitoring these metrics on CoinMarketCap, users can gain a deeper understanding of Bitcoin's market behavior, enabling them to make more informed decisions.

Bitcoin Dominance: Why It Matters

Bitcoin dominance is a metric that represents Bitcoin's share of the total cryptocurrency market capitalization. This metric is crucial for understanding Bitcoin's influence on the broader crypto market. A high dominance percentage often indicates a strong market presence, while a declining dominance may signal a shift towards altcoins.

On CoinMarketCap, Bitcoin dominance is updated in real-time, allowing users to track changes in market dynamics. This metric is particularly useful for portfolio diversification, as it helps investors gauge the relative strength of Bitcoin compared to other cryptocurrencies.

Essential Tools on CoinMarketCap for Bitcoin Analysis

CoinMarketCap offers a suite of tools designed to enhance Bitcoin analysis. From price alerts and portfolio tracking to API integrations and educational resources, these tools provide a comprehensive toolkit for both novice and experienced investors.

One of the standout features is the "Market Pairs" section, which lists all the trading pairs for Bitcoin across various exchanges. This feature allows users to compare prices and trading volumes, ensuring they get the best deals. Other tools, like the "Historical Data" section and "Crypto Converter," further simplify the investment process, making CoinMarketCap a one-stop platform for Bitcoin analysis.

Strategies for Investors Using Bitcoin CoinMarketCap

Investing in Bitcoin requires a well-thought-out strategy, and CoinMarketCap provides the data needed to formulate one. Whether you're a day trader looking for short-term gains or a long-term investor seeking to hold Bitcoin as a store of value, CoinMarketCap offers insights that can guide your decisions.

For instance, analyzing historical data and price trends can help identify optimal entry and exit points. Monitoring trading volumes and liquidity can provide insights into market activity, while metrics like Bitcoin dominance can inform diversification strategies. By leveraging the tools and data on CoinMarketCap, investors can minimize risks and maximize returns.

Future Trends: Where Bitcoin and CoinMarketCap Are Heading

The future of Bitcoin and CoinMarketCap is intertwined, as both continue to evolve in response to market demands. Bitcoin is likely to see increased adoption, both as a currency and a store of value, driven by advancements in technology and regulatory clarity. Meanwhile, CoinMarketCap is expected to expand its offerings, incorporating more advanced analytics and features to stay ahead of the curve.

Emerging trends like decentralized finance (DeFi), non-fungible tokens (NFTs), and Web3 are also set to influence Bitcoin's trajectory and CoinMarketCap's role in the ecosystem. By staying informed and adapting to these changes, both platforms and their users can capitalize on new opportunities in the ever-evolving crypto landscape.

Risks and Challenges in Bitcoin Investments

While Bitcoin offers significant opportunities, it also comes with risks and challenges. Market volatility, regulatory uncertainty, and security concerns are some of the key issues investors need to navigate. CoinMarketCap helps mitigate these risks by providing accurate and up-to-date information, enabling users to make informed decisions.

However, it's essential for investors to conduct their own research and exercise caution. Diversifying portfolios, setting realistic expectations, and staying informed about market trends are crucial steps for managing risks in Bitcoin investments.

FAQs About Bitcoin CoinMarketCap

- What is Bitcoin's current market capitalization? You can find Bitcoin's real-time market capitalization on CoinMarketCap under its detailed statistics section.

- How does CoinMarketCap calculate Bitcoin's price? CoinMarketCap aggregates prices from various exchanges to provide an average, ensuring accuracy and transparency.

- Is CoinMarketCap free to use? Yes, CoinMarketCap is free to use, although it offers premium features for advanced analytics and API access.

- Can I track my Bitcoin investments on CoinMarketCap? Yes, CoinMarketCap offers a portfolio tracker that allows users to monitor their Bitcoin and other crypto holdings in one place.

- What is Bitcoin dominance? Bitcoin dominance measures Bitcoin's share of the total cryptocurrency market capitalization, a metric that is continually updated on CoinMarketCap.

- Is CoinMarketCap owned by Binance? Yes, CoinMarketCap was acquired by Binance in 2020, although it operates independently to maintain its credibility.

By leveraging the tools and insights provided by CoinMarketCap, investors can make smarter, data-driven decisions in the volatile yet rewarding world of Bitcoin investments.

Article Recommendations