When you refinance a loan, you are essentially taking out a new loan to pay off your existing one. This can be done for a variety of reasons, such as to get a lower interest rate, to consolidate debt, or to change the terms of your loan. Quicken Loans is one of the largest mortgage lenders in the United States, and they offer a variety of refinance options.

There are many benefits to refinancing your loan with Quicken Loans. First, you may be able to get a lower interest rate. This can save you money on your monthly payments and over the life of your loan. Second, you may be able to consolidate your debt into a single monthly payment. This can make it easier to manage your finances and pay off your debt faster. Third, you may be able to change the terms of your loan. For example, you may be able to extend the term of your loan or change the type of loan you have.

If you are considering refinancing your loan, it is important to compare rates from multiple lenders. This will help you get the best possible deal on your new loan. You should also consider the fees associated with refinancing. These fees can vary from lender to lender, so it is important to factor them into your decision.

quicken loan refinance rates

Refinancing your loan can be a smart financial move, and Quicken Loans is one of the largest and most reputable mortgage lenders in the United States. Here are seven key aspects to consider when exploring Quicken loan refinance rates:

- Interest rates: Quicken Loans offers competitive interest rates on its refinance loans.

- Loan terms: Quicken Loans offers a variety of loan terms, so you can choose the one that best meets your needs.

- Fees: Quicken Loans charges a variety of fees for its refinance loans, so be sure to compare them to other lenders before making a decision.

- Closing costs: Closing costs are the fees you pay to complete your refinance loan. Quicken Loans' closing costs are typically in line with the industry average.

- Customer service: Quicken Loans has a reputation for providing excellent customer service.

- Online tools: Quicken Loans offers a variety of online tools to help you manage your loan.

- Pre-approval: Getting pre-approved for a refinance loan can help you lock in a low interest rate.

When considering Quicken loan refinance rates, it's important to compare them to rates from other lenders. You should also consider the fees and closing costs associated with refinancing. By taking the time to compare your options, you can find the best possible deal on your refinance loan.

1. Interest rates

When it comes to refinancing your loan, the interest rate is one of the most important factors to consider. A lower interest rate can save you money on your monthly payments and over the life of your loan. Quicken Loans offers competitive interest rates on its refinance loans, so you can be sure you're getting a good deal.

- How interest rates affect your monthly payments: The interest rate on your loan determines how much you will pay each month. A higher interest rate means higher monthly payments, while a lower interest rate means lower monthly payments.

- How interest rates affect the total cost of your loan: The interest rate on your loan also affects the total cost of your loan. A higher interest rate means you will pay more interest over the life of your loan, while a lower interest rate means you will pay less interest.

- How to get the best interest rate on your refinance loan: There are a few things you can do to get the best interest rate on your refinance loan. First, shop around and compare rates from multiple lenders. Second, improve your credit score. A higher credit score will qualify you for a lower interest rate.

By understanding how interest rates work, you can make an informed decision about whether or not to refinance your loan. If you are considering refinancing, be sure to compare rates from Quicken Loans and other lenders to get the best possible deal.

2. Loan terms

When refinancing your loan, the loan term is the length of time you have to repay the loan. Quicken Loans offers a variety of loan terms, from 15 years to 30 years. The loan term you choose will affect your monthly payments and the total cost of your loan.

- Shorter loan terms: Shorter loan terms, such as 15 years or 20 years, have higher monthly payments but lower total interest costs. This is because you are paying off the loan more quickly.

- Longer loan terms: Longer loan terms, such as 25 years or 30 years, have lower monthly payments but higher total interest costs. This is because you are paying off the loan over a longer period of time.

The best loan term for you will depend on your individual circumstances and financial goals. If you can afford higher monthly payments, a shorter loan term may be a good option for you. If you need to keep your monthly payments low, a longer loan term may be a better choice.

It is important to note that Quicken Loans also offers adjustable-rate mortgages (ARMs). ARMs have interest rates that can change over time. This means that your monthly payments could increase or decrease over the life of your loan. If you are considering an ARM, be sure to understand how interest rates work and how they could affect your monthly payments.

3. Fees

When comparing quicken loan refinance rates, it is important to consider the fees associated with refinancing. Quicken Loans charges a variety of fees, including an application fee, an origination fee, and a closing fee. These fees can vary depending on the loan amount, the loan term, and your credit score. It is important to compare the fees charged by Quicken Loans to the fees charged by other lenders to get the best possible deal.

For example, if you are refinancing a $200,000 loan with a 30-year term, Quicken Loans may charge an application fee of $500, an origination fee of $1,000, and a closing fee of $1,500. This means that you would pay $2,500 in fees to refinance your loan with Quicken Loans. However, another lender may only charge an application fee of $250, an origination fee of $750, and a closing fee of $1,000. This means that you would only pay $2,000 in fees to refinance your loan with this other lender.

It is important to note that the fees charged by Quicken Loans are not always the lowest in the industry. However, Quicken Loans is known for its competitive interest rates and excellent customer service. Therefore, it is important to compare the overall cost of refinancing your loan with Quicken Loans to the overall cost of refinancing your loan with other lenders. This will help you make the best decision for your individual needs.

4. Closing costs

Closing costs are an important consideration when refinancing your loan. These fees can vary depending on the lender, the loan amount, and the loan term. Quicken Loans' closing costs are typically in line with the industry average, so you can be sure you're not paying too much.

- Title fees: Title fees are paid to the title company for searching the property's title and ensuring that it is clear. These fees vary depending on the state in which you live.

- Lender fees: Lender fees are paid to the lender for processing your loan application and underwriting your loan. These fees can include an application fee, an origination fee, and a closing fee.

- Third-party fees: Third-party fees are paid to other parties involved in the closing process, such as the appraisal company, the surveyor, and the attorney. These fees can vary depending on the services that are required.

By understanding what closing costs are and how they are calculated, you can budget for these fees and avoid any surprises at the closing table. Quicken Loans can provide you with a detailed estimate of your closing costs so that you know exactly what to expect.

5. Customer service

When you refinance your loan with Quicken Loans, you can expect to receive excellent customer service. Quicken Loans has a team of dedicated loan officers who are available to answer your questions and help you through the refinance process. They are also committed to providing fast and efficient service, so you can get your loan refinanced quickly and easily.

The importance of customer service cannot be overstated when it comes to refinancing your loan. Refinancing can be a complex process, and it's important to have a lender that you can trust to guide you through the process. Quicken Loans has a proven track record of providing excellent customer service, so you can be sure that you're in good hands.

Here are a few examples of the excellent customer service that Quicken Loans provides:

- Quicken Loans has a dedicated team of loan officers who are available to answer your questions and help you through the refinance process.

- Quicken Loans is committed to providing fast and efficient service, so you can get your loan refinanced quickly and easily.

- Quicken Loans offers a variety of online tools and resources to help you manage your loan and track your progress.

If you're considering refinancing your loan, Quicken Loans is a great option. They offer competitive interest rates, a variety of loan terms, and excellent customer service. With Quicken Loans, you can be sure that you're getting the best possible deal on your refinance loan.

6. Online tools

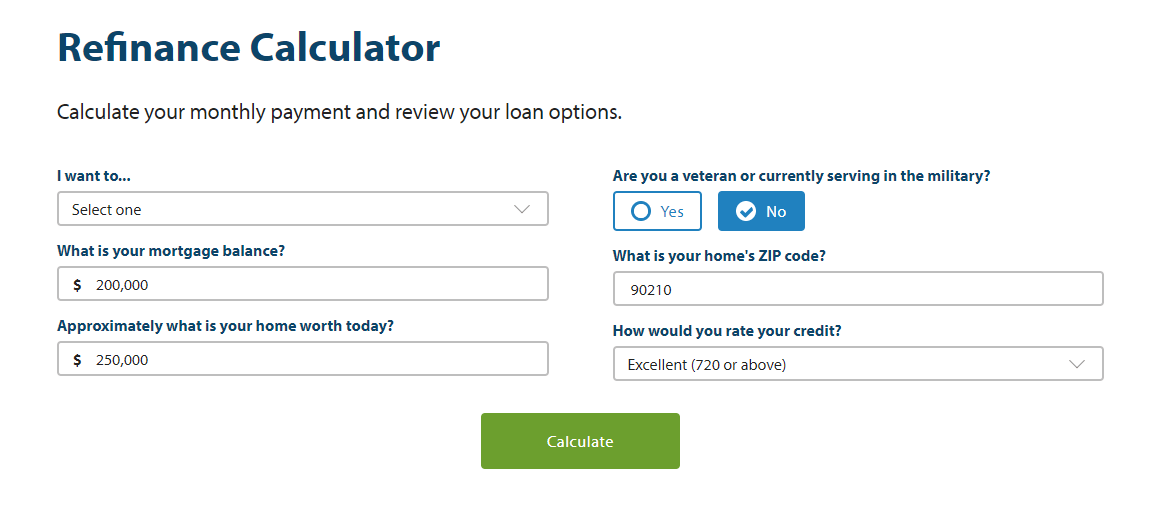

Quicken Loans offers a suite of online tools that can help you manage your loan and track your progress. These tools can be especially helpful if you are refinancing your loan, as they can provide you with real-time updates on your loan status and help you stay organized throughout the process.

One of the most important online tools that Quicken Loans offers is their loan portal. The loan portal allows you to view your loan details, make payments, and track your progress towards paying off your loan. You can also use the loan portal to communicate with your loan officer and ask questions about your loan.

Another helpful online tool that Quicken Loans offers is their mortgage calculator. The mortgage calculator can help you estimate your monthly payments and compare different loan options. This can be a valuable tool if you are considering refinancing your loan, as it can help you determine which loan option is right for you.

Quicken Loans also offers a variety of other online tools, such as a budget calculator, a home affordability calculator, and a credit score tracker. These tools can help you manage your finances and make informed decisions about your loan.

By taking advantage of the online tools that Quicken Loans offers, you can make the loan refinancing process easier and more efficient. You can stay organized, track your progress, and make informed decisions about your loan. This can help you save time and money, and get the most out of your refinance loan.

7. Pre-approval

When you refinance your loan, the interest rate is one of the most important factors to consider. A lower interest rate can save you money on your monthly payments and over the life of your loan. Getting pre-approved for a refinance loan can help you lock in a low interest rate.

When you get pre-approved for a loan, the lender will review your financial information and give you a conditional commitment for a loan amount and interest rate. This means that you know how much you can borrow and what your interest rate will be before you even start shopping for a home. This can give you a significant advantage when it comes to negotiating with lenders.

For example, let's say you are looking to refinance a $200,000 loan. You get pre-approved for a loan with an interest rate of 3.5%. However, when you start shopping for a home, you find a lender that is offering an interest rate of 3.25%. Because you are pre-approved, you can use this information to negotiate with the lender and get a lower interest rate on your loan.

Getting pre-approved for a refinance loan is a simple and easy process. You can usually apply online or over the phone. Once you have been pre-approved, you will receive a pre-approval letter that you can use to shop for a home.

If you are considering refinancing your loan, getting pre-approved is a smart move. It can help you lock in a low interest rate and save you money on your monthly payments.

quicken loan refinance rates FAQs

Refinancing your mortgage can be a complex process, but it can also be a great way to save money on your monthly payments and get a better interest rate. Quicken Loans is one of the largest mortgage lenders in the United States, and they offer a variety of refinance options. Here are six frequently asked questions about quicken loan refinance rates:

Question 1: What are quicken loan refinance rates?

Quicken Loans offers a variety of refinance rates, depending on your credit score, the amount of money you want to borrow, and the loan term you choose. You can get a personalized quote by visiting the Quicken Loans website or by calling a loan officer.

Question 2: How can I get the best quicken loan refinance rate?

There are a few things you can do to get the best quicken loan refinance rate:1. Shop around and compare rates from multiple lenders.2. Improve your credit score.3. Get a longer loan term.4. Make a larger down payment.

Question 3: What are the closing costs for a quicken loan refinance?

The closing costs for a quicken loan refinance will vary depending on the loan amount, the loan term, your credit score, and other factors. However, you can expect to pay between 2% and 5% of the loan amount in closing costs.

Question 4: How long does it take to refinance a loan with quicken loans?

The time it takes to refinance a loan with quicken loans will vary depending on the complexity of your loan and your financial situation. However, you can expect the process to take between 30 and 60 days.

Question 5: Is it worth it to refinance my loan?

Whether or not it is worth it to refinance your loan depends on a number of factors, including your current interest rate, the new interest rate you can get, the closing costs, and how long you plan to stay in your home. You can use a refinance calculator to estimate how much you could save by refinancing.

Question 6: How can I apply for a quicken loan refinance?

You can apply for a quicken loan refinance online, over the phone, or by visiting a local branch. The application process is simple and straightforward, and you will need to provide information about your income, assets, and debts.

Refinancing your mortgage can be a great way to save money on your monthly payments and get a better interest rate. Quicken Loans is one of the largest mortgage lenders in the United States, and they offer a variety of refinance options. If you are considering refinancing your loan, be sure to compare rates from multiple lenders and get a personalized quote from Quicken Loans.

To learn more about quicken loan refinance rates, visit the Quicken Loans website or call a loan officer.

Tips for getting the best quicken loan refinance rates

Refinancing your mortgage can be a great way to save money on your monthly payments and get a better interest rate. Quicken Loans is one of the largest mortgage lenders in the United States, and they offer a variety of refinance options. Here are five tips for getting the best quicken loan refinance rates:

Tip 1: Shop around and compare rates from multiple lenders.

Don't just go with the first lender you find. Take the time to shop around and compare rates from multiple lenders. This will help you get the best possible rate on your refinance loan.

Tip 2: Improve your credit score.

Your credit score is a major factor in determining the interest rate you will qualify for. If you have a good credit score, you will be able to get a lower interest rate on your refinance loan. There are a number of things you can do to improve your credit score, such as paying your bills on time, keeping your credit utilization low, and disputing any errors on your credit report.

Tip 3: Get a longer loan term.

The loan term is the length of time you have to repay your loan. A longer loan term will result in lower monthly payments, but you will pay more interest over the life of the loan. If you can afford the higher monthly payments, a shorter loan term may be a better option for you.

Tip 4: Make a larger down payment.

The down payment is the amount of money you pay upfront when you refinance your loan. A larger down payment will result in a lower loan amount, which will in turn result in a lower monthly payment. If you have the money available, making a larger down payment can be a good way to save money on your refinance loan.

Tip 5: Get pre-approved for a loan.

Getting pre-approved for a loan will give you a better idea of how much you can borrow and what your interest rate will be. This can help you make informed decisions about your refinance loan and avoid any surprises down the road.

By following these tips, you can improve your chances of getting the best quicken loan refinance rates. Refinancing your mortgage can be a great way to save money on your monthly payments and get a better interest rate, so it's worth taking the time to do it right.

Summary

Refinancing your mortgage can be a smart financial move, but it's important to do your research and compare rates from multiple lenders. By following the tips in this article, you can increase your chances of getting the best possible deal on your refinance loan.

Conclusion

Refinancing your mortgage with Quicken Loans can be a smart financial move. By comparing rates from multiple lenders and following the tips in this article, you can increase your chances of getting the best possible deal on your refinance loan.

Quicken Loans offers a variety of refinance options, competitive interest rates, and excellent customer service. If you are considering refinancing your loan, Quicken Loans is a great option to consider.

Article Recommendations